Contents

The Airbnb IPO - A Primer

2 minutes read

14 May 2024

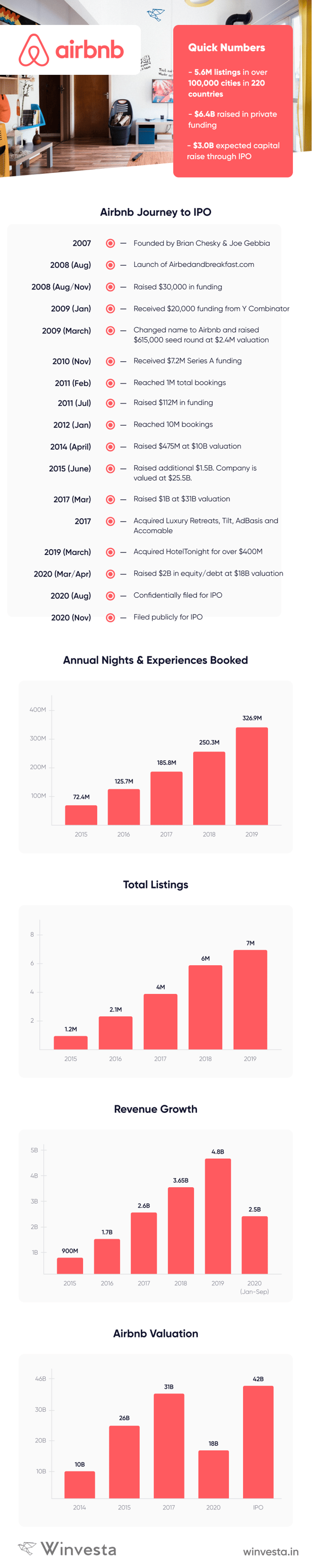

American vacation rental provider Airbnb aims to go public this week with a price range of $56 to $60 per share. The company seeks a valuation of over $40B on a fully diluted basis as per the latest filings submitted to the Securities and Exchange Commission. The plan is to initially raise as much as $3B in IPO with existing investors seeking to sell stock worth $96M at the time of going public.

Last month, the company released first S-1, reporting $219M in net income on $1.34B revenue in the Q3, which is down 19% from last year. The situation was even bleak in Q2 when the global reservations dropped by half, and revenue fell by 72% on a yearly basis.

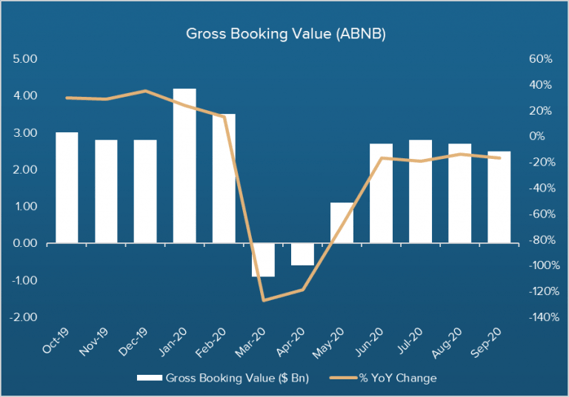

Airbnb’s gross booking value dropped from $3.5B in February to -$900M in March (due to cancellations). Bookings recovered during the summer, but are still not up back to last year’s level.

Source: Airbnb S-1 Filing

Airbnb Vs Peers

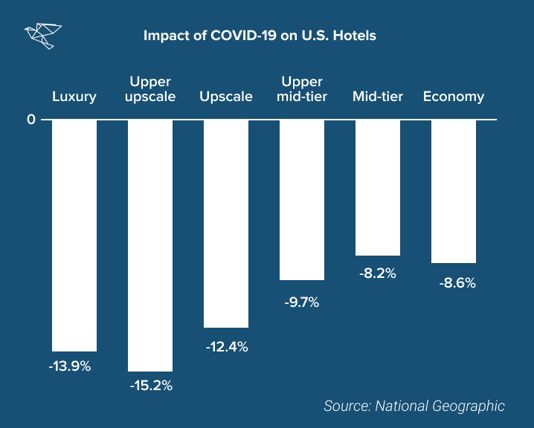

Let us have a look at how the hotel industry suffered through the pandemic. The highest impact was felt at the larger upscale hotels which host conventions, followed by luxury hotels and resorts.

Revenue per available room percentage change, week ending March 7.

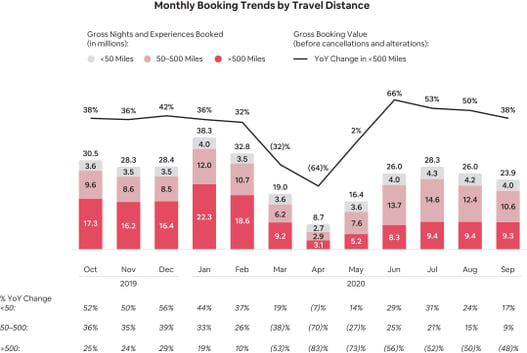

On the other hand, Airbnb’s unique offerings and focus on core business practices allowed it to recover quickly. Changing travel patterns like opting for cabins or mountain stays in remote areas to escape pandemic assisted the company’s recovery. Airbnb also saw growth in domestic long-term stays, and in short distance bookings.

Airbnb Monthly Booking Trends. Source: Airbnb S-1 Filing

Customer Loyalty

Airbnb gauged what customers were skeptical about and went to great lengths to address their issues. Reluctance on new bookings and uncertainty of travel restrictions were the key pain points. The company issued a blanket refund policy offering last-minute cancellations and full refunds. It went to lengths to ensure and display safety procedures and measures adopted by the hosts to build trust.

During the pandemic, the company maintained a steady number of active listings at around 5.6M (and 7.4M total listings).

An excerpt from the company’s S-1 Filing:

“As a result of strong guest loyalty, we have a growing number of repeat guests on Airbnb. Guest revenue retention and increasing repeat guests have grown due to our brand and community. As a result, 69% of our revenue in 2019 was generated from stays in that year by repeat guests, defined as guests with at least one prior booking, up from 66% in 2018.”

Airbnb Infographic

This data has been taken from the S-1 Filing. Neither Winvesta nor RiskSave Technologies Ltd take any responsibility for the accuracy of the information presented.

Risks of investing in Airbnb

One must also understand the risks of investing in Airbnb. The company has lost money each year since launching in 2008, and revenues have been hit massively this year. There are chances of cities implementing zoning restrictions on short-term rentals. Additionally, as a public company, Airbnb would have to take more responsibility for promoting safety and policing crime. Further, deteriorating US-China relations could hinder Airbnb’s growth prospects.

Disclaimer: Please note that past performance is not a guide to future returns and that your capital is at risk.

How to invest in Airbnb from India

With Winvesta, you can invest in Airbnb shortly after it starts trading in the secondary market on the US exchange. Sign up today and get access to Airbnb and 3000+ other US-listed stocks and ETFs from India.

Download Now