Contents

How Diverse Is India’s Wealth?

3 minutes read

16 December 2024

India is a diverse country. There are many different ways to divide Indian society. There are states, castes, religions, communities, and countless other elements. However, along with the social diversity, there is an equally evident economic diversity. And it is monumental! Thorough knowledge of India’s wealth distribution is thus a key tool for policymakers. In this article, we look at how diverse is India's wealth.

How Much is India's Wealth?

A wealth report by Karvy says the individual wealth in India rose 9.62% in FY19 to US$5.73 trillion. India stands fifth in terms of the number of HNI (high net-worth individuals) and U-HNI (ultra-high net worth individuals) in the world. In the past five years, the HNI population in the country has seen an eye-catching rise of 64.10% to reach 256,000 in 2018 from 156,000 in 2014. A HurunGlobal Rich List 2020 Survey states, India creates three US dollar billionaires a month! But how diverse is India's wealth? Oxfam reports that India’s richest 1% population holds around 42.5% of the overall national wealth. On the other hand, the bottom 50% of the pyramid accounts for a mere 2.8%. The disparity is immense! Over the last year, the top 1% saw a 46% rise in their wealth while the bottom 50% witnessed a paltry 3% rise.What are Different Sources of Wealth in India?

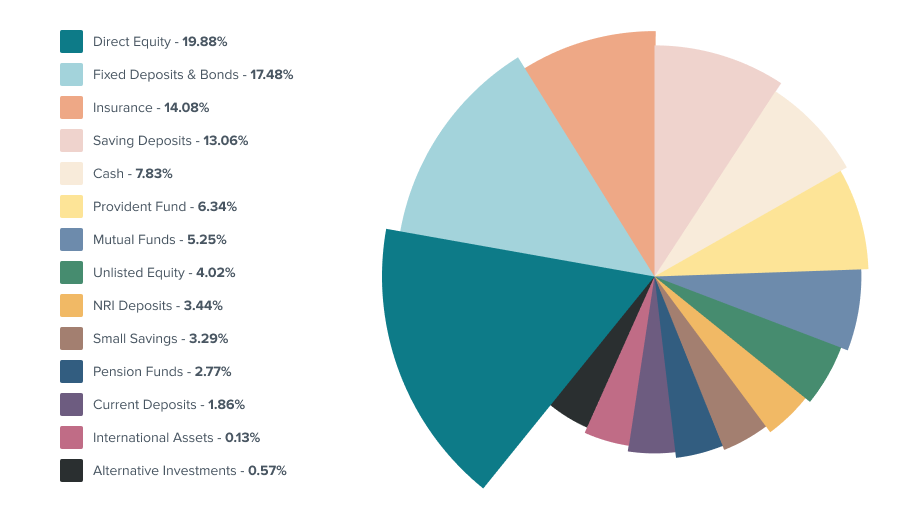

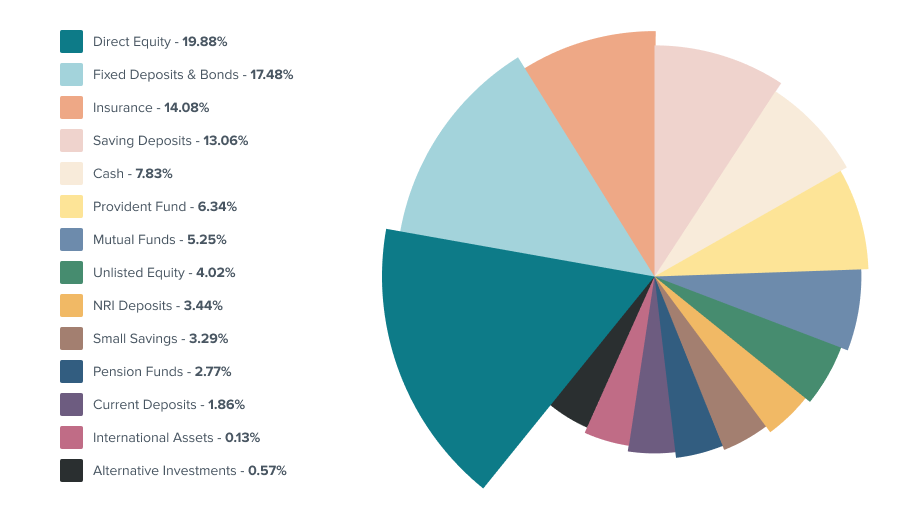

There are two main sources of wealth – financial assets and physical assets. Financial assets include direct equity, fixed income and bonds, insurance, savings bank deposits, cash, provident fund, mutual funds, unlisted equity, small savings, pension funds, current deposits, alternative investments, and international assets. Physical assets include gold, real estate, diamond, silver, platinum, other gems, and jewellery. As mentioned before, the wealth trend in the country is inclined towards financial assets. Wealth in financial assets increased by 10.96% and was valued US$3.49 trillion in FY19. Cash, Savings Accounts, Insurance, Fixed Deposits, and Direct Equity are the most preferred investment channels and cumulatively account for 72.33% contribution in overall financial assets. Mutual Funds have emerged as a popular investment channel. This is evident from the high SIP investments. SIP investment in MFs increased by 38% with a net inflow of US$12.34 Bn compared to FY18.

Source: Karvy Wealth Report 2019

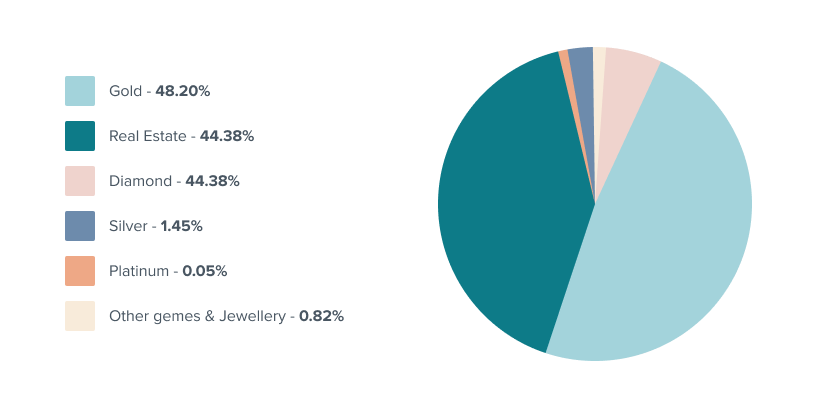

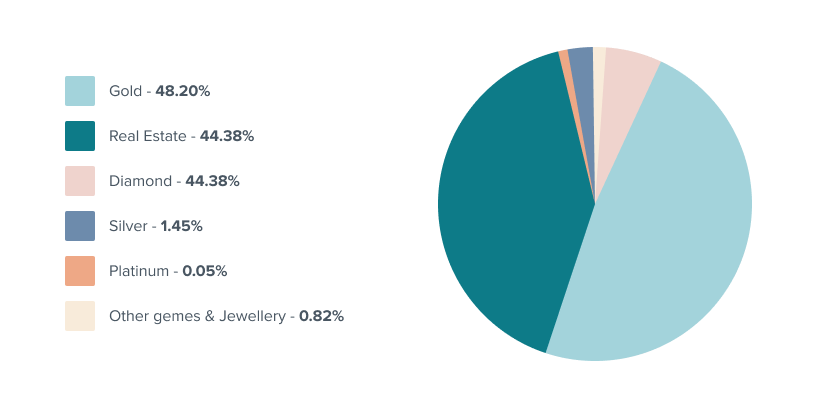

On the other hand, gold and real estate are the two main contributors to wealth in physical assets. Together, they account for 92.57% of the overall segment. FY19 showed a growth of 7.59% with a valuation of US$2.22 trillion.

Source: Karvy Wealth Report 19

Continuing with the current trends, by FY24, the individual wealth in India will showcase a healthy CAGR of 13.19%. The valuation is expected to reach US$10.64 Trillion with a 66.11% allocation in financial assets.How Much of India's Wealth Invested Overseas?

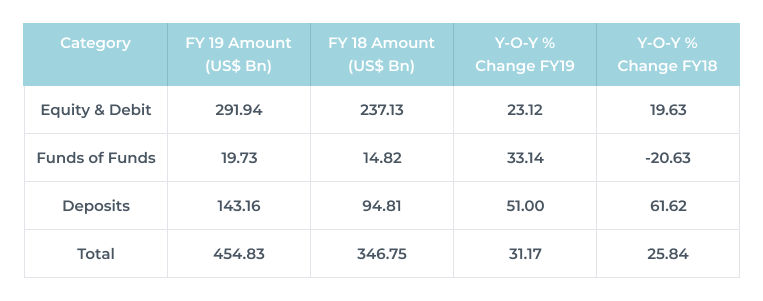

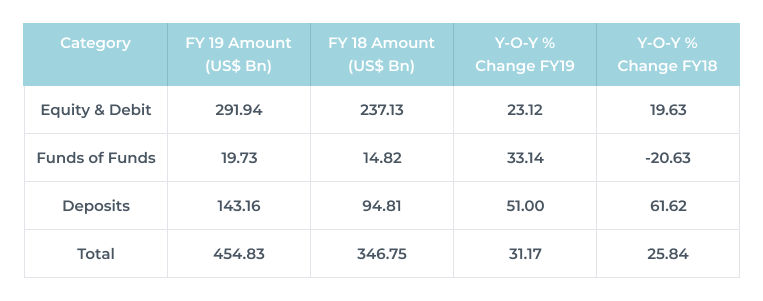

Considerably less compared to the domestic base. RBI’s Liberalized Remittance Scheme (LRS) allows Indians to invest and remit up to US$250,000 overseas per financial year. Regulatory changes and technology have now made it easy for an average investor to access global investment products at a fair cost. Even though there’s a firm bias for domestic markets, the stark outperformance of the US stock market has encouraged investors to look abroad. Indian HNIs have long looked at overseas investing with keen interest to diversify assets and reduce INR risk. International investments have also helped them match future liabilities like retiring overseas and children’s education. International investing is now becoming accessible at costs comparable to domestic investments, and it would be interesting to see how this change translates into an increase in overseas wealth. Here’s a table outlining individual wealth in international assets.

Source: Karvy Wealth Report 2019

Why Haven't Indian Investors Invested More Overseas?

- Home bias: In the investing world, there is a phenomenon known as home bias, where investors prefer to invest in their home country, under a belief that they know their stock market while overestimating the risk of investing abroad

- Risk aversion: As a new investor, the general advice is to ‘play safe’ and stay away from risk. Indian investors tend to hold more in cash deposits and gold than in the stock market. Weak corporate governance, frauds, and asymmetric market information tend to dampen investor confidence in the Indian stock market.

- Lack of cost-efficient and convenient channels: Investing overseas has long been limited to HNIs and professional investors due to high minimums, complicated account opening processes, and high costs. Platforms like Winvesta are shattering those barriers rapidly.

- Lack of awareness: Many Indian investors are not aware that they can invest up to USD 250k overseas every year. In a survey done by Winvesta, over 65% of respondents were not aware of this.

How Things are Changing?

Till recently, there was no convenient and easily accessible channel to invest in global financial products. A few brokerage houses and portfolio management services provided overseas investment access but with high fees and larger minimum investment amounts. However, platforms like Winvesta are now trying to provide access to US stocks and ETFs without any commissions or significant capital requirements. Technology has accelerated the scope of wealth creation in India ushering a ‘WealthTech’ era and rapidly transforming the wealth management sector.What are the Trends of Individual Wealth in India?

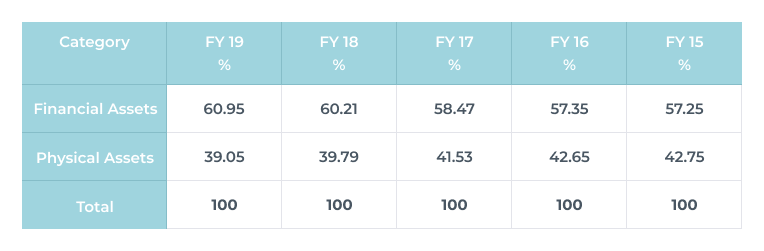

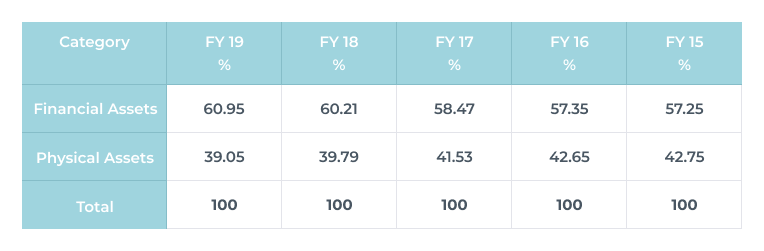

We've seen how diverse is India's wealth. As the country becomes wealthier, allocation moves from physical assets to financial assets. In the past five years, there has been a lot of buzz around the ‘financialisation’ of assets. Investments in financial assets grew from 57.25% in 2015 to 60.95% in 2019. This trend will continue as India continues to become wealthier.

Source: Karvy Wealth Report 2019

Contributed by Prateek Jain

He is the Co-founder & President of Winvesta. Before Winvesta, Prateek worked at Deutsche Bank for 11 years