Contents

A Weak Rupee's Impact On Cost Of Foreign Education

2 minutes read

14 May 2024

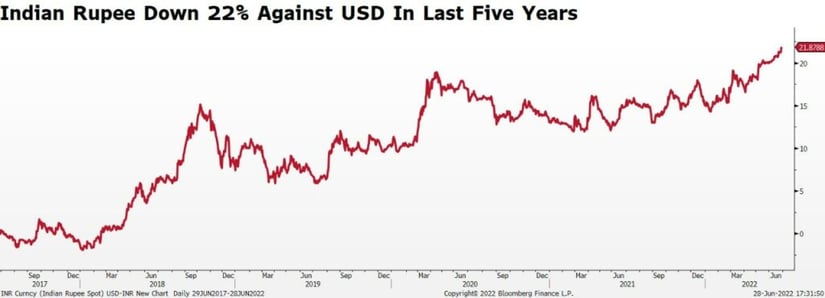

The Indian Rupee has depreciated ~22% against the US Dollar over the last five years. The cost of education in the US has also increased. A combination of both increases the burden on aspirational Indian families who are saving up to send their kids abroad for further education.

Increasing Cost Of Education In The US

232K Indian students went to the US for higher education in 2021, up 12% from 2020. The desire to study overseas has amplified over the years, mainly due to the scope and exposure.

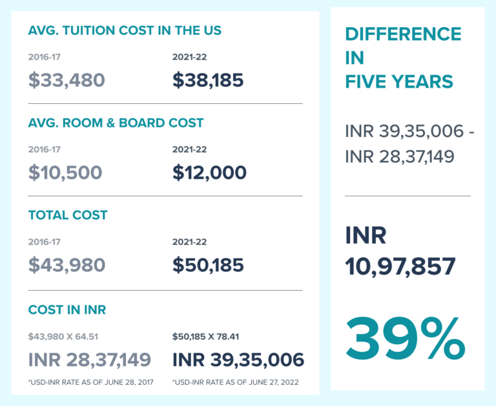

The cost of education in the US has increased ~40% in the last five years. The average tuition cost for the 2021-22 academic year at private universities in the US rose 15% to $38,185 from $33,480 in 2016-17. Average room and board costs at universities also increased to $12K per academic year, from $10.5K in 2016-17.

Let’s explain this to you with an example:

These are just basics. Add to that food, books, commuting, clothing, and other emergency expenses; the total runs into tens of thousands of dollars for just one academic year.

These costs will only increase with time, causing a bigger dent in your savings. Savings that you have accumulated in INR but have to spend in USD.

Mitigating The Risk

So how do you safeguard your hard-earned money from the depreciation threat? Cross-border investing in today’s world has become more straightforward than two decades ago.

You can now save, invest your funds overseas, and grow your wealth in USD. That ensures sufficient foreign currency funds when your child needs them. You will avoid the last-minute scramble to arrange for extra funds if the INR weakens further.

Where can you invest?

There are multiple opportunities – Equities, ETFs, Bonds, and Real Estate. You can invest in liquid vs. illiquid and medium vs. low-risk assets depending on your time horizon.

Moreover, you don’t need to invest a lump sum. You can also buy fractional shares and invest in fractional real estate. By doing so, you will not only safeguard your funds against the depreciation risk, but a diversified portfolio will also protect your capital against market volatility.

Conclusion

Neo-banks like Winvesta provide options to save and grow your wealth overseas in today’s borderless world. Through Winvesta’s Multi-Currency Account, you can not only save your funds in USD but also convert them into 30+ currencies and use them as per your goal-based plans. With Winvesta’s integrated investment account, you can also invest those funds in US stocks and ETFs.

A depreciating currency should not dampen your desire to send your ward overseas. Instead, a globally diversified investment strategy could be the right foil to protect your funds from risk, and you can start your global savings journey with Winvesta within minutes!

Access 4500+ US Stocks and ETFs with Winvesta

Get an account in minutes and start investing as soon as today

Get StartedAll content provided by Winvesta India Technologies Ltd. is for informational and educational purposes only and is not meant to represent trade or investment recommendations. Remember capital is at risk. Terms & Conditions apply.

Contributed by Hormaz Fatakia

Hormaz is the Financial Content Lead at Winvesta. Before Winvesta, Hormaz worked at Bloomberg Quint where he was a senior writer.