Contents

Here's How Much More Money You Would have Made in the Last Decade if you Invested in US Instead of India

2 minutes read

14 May 2024

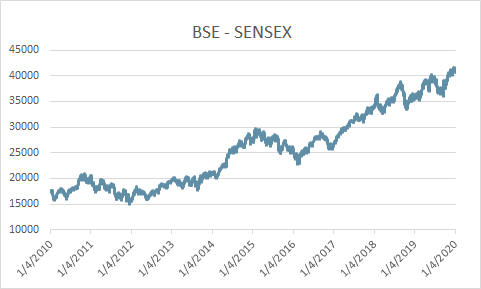

Indian stock markets had a good run last decade, more than doubling up in value since 2010. BSE Sensex, one of India’s most liquid benchmark Index started the decade at around 17,500 and ended at over 41,000, clocking in over 136% return.

Source: Bloomberg Data

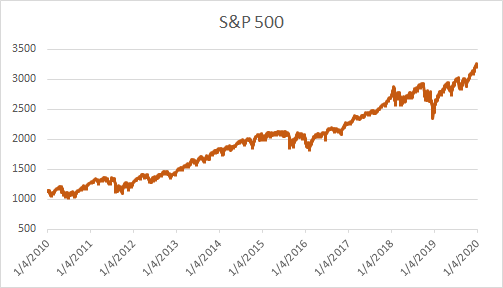

In the same period, S&P 500, USA’s most liquid benchmark index produced a slightly higher yield of 190%, starting the decade at 1115 and ending at 3231.

Source: Bloomberg Data

A simple comparison of charts for US vs Indian Stock Market would make one think that US investments would have outperformed by 54%, or by 4.4% per year (compounded). The answer is not so simple though.

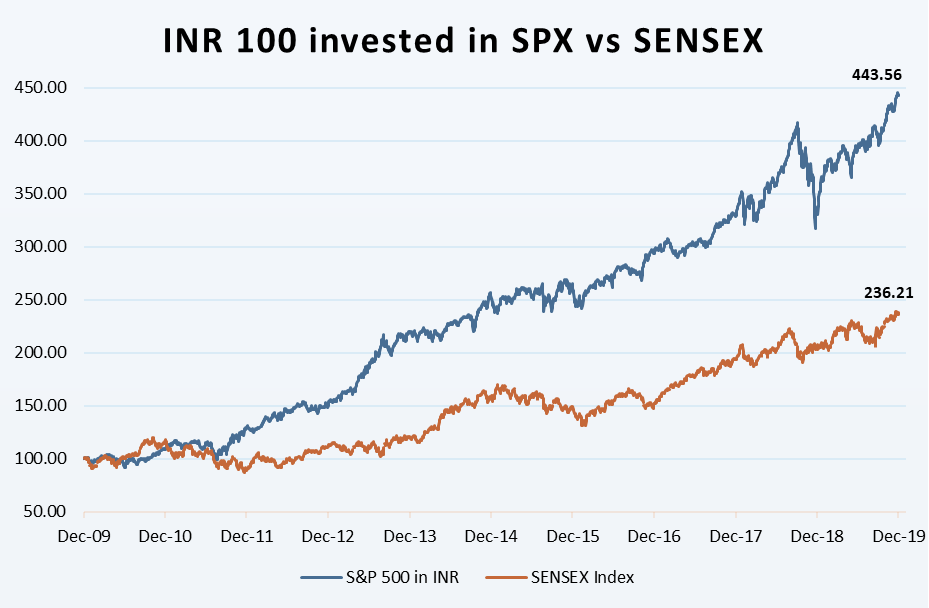

One important component when investing in US stock markets from India is that US markets are denominated in USD, while Indian investments are typically in INR. So for a true comparison, we need to compare how much returns an Indian resident would have generated if he invested INR 100 into S&P 500 (by buying USD for INR 100 in 2010) vs investing those in Sensex. Here’s the simple math to get to the result

Data

-

SENSEX

S&P 500

USD INR

31-Dec-09

17,464.81

1,115.10

46.53

31-Dec-19

41,253.74

3,230.78

71.38

Investment in Sensex

Starting Capital = INR 100

Sensex Return = 136.21%

Ending Capital = INR 236.21

Investment in S&P 500

Starting Capital = USD 100/46.53 = $2.15

S&P 500 Return = 189.73%

Ending Capital = USD 2.15*(1.8973+1) = $6.23

Ending Capital in INR = 6.23*71.38 = INR 444.50

Outperformance = 208.3%

We can chart this outperformance by converting S&P 500 into INR, and comparing the performance with Sensex:

Source: Bloomberg Data

INR 100 invested last decade in S&P 500 in US would have returned INR 444, while the same amount invested in Sensex in India would have returned INR 236

When we add the USD/INR FX conversion to the equation, we get a much higher outperformance of over 208% or 11.9% per year (compounded). While 4.4% annual outperformance we saw by comparing only index returns may not be enough for some investors to consider investing in the US, an 11.9% annual outperformance is quite significant to be ignored.

How can Indian Residents Invest in the US Markets?

Winvesta is making it easier for Indian residents to invest in international markets including US stocks and ETFs like S&P 500. Open an account in minutes, and start diversifying your portfolio

Get StartedDisclaimer: Past performance is not an indication of future performance and capital may be at risk. The information provided in this article is meant only for general reading purposes and the views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Contributed by Prateek Jain

He is the Co-founder & President of Winvesta. Before Winvesta, Prateek worked at Deutsche Bank for 11 years