Contents

- What is a SPAC?

- The structure of a SPAC

- SPAC popularity in the recent years

- Benefits of SPACs against traditional IPOs

- Risks in SPACs investing

- Events In An SPAC Lifecycle

- Things to consider when investing in a SPAC

- Notable SPAC Mergers and Acquisitions

- How to Invest in SPACs from India?

SPACs - All You Need to Know if You are Investing from India

9 minutes read

14 May 2024

What is a SPAC?

If you invest in US markets, it is unlikely that you haven’t heard of SPACs yet. SPACS have taken the world by storm, and they only seem to be growing. While many may assume that SPACs are a recent trend, the truth is they have existed for decades, with the first SPAC created in 1993.

As per Investopedia, a Special Purpose Acquisition Company (SPAC) has no commercial operations. Its purpose is to raise capital through an initial public offering (IPO) to acquire an existing company. This means that a SPAC is essentially a shell company that doesn’t make and sell products or provides any form of business service to consumers or other companies.

Generally, a team of Wall Street professionals or Private Equity and Hedge Fund managers create a SPAC. Off lately, company executives like Richard Branson and Chamath Palihapitiya have dived into SPACs.

SPACs are also known as “blank check companies” because general investors buying into the IPO may not know the eventual acquisition. Public investors usually trust the founders of the SPAC since they have credibility. At least 90% of IPO proceeds are required to be held in the trust until the SPAC closes a business combination. Moreover, the SPAC offers investors an opportunity to vote on any proposed acquisition. They can obtain a pro-rata distribution of the cash held in trust if they don’t like the proposed target or terms.

The structure of a SPAC

The following participants and structure typically comprise SPACs:

1. SPAC sponsors

This is the management or the founders of the SPAC, who are responsible for completing a favourable acquisition in the given time (18 months – 2 years). They receive 20% ownership in the SPAC for nominal consideration, generally referred to as founders’ shares. However, these shares have no claim on the cash held in trust, which means that if these founders fail to close a deal, their equity stake will become worthless.

The founders generally take care of the IPO expenses and operating costs. They often have a background in M&A, private equity, or entrepreneurship. Investors rely on their industry knowledge and negotiating expertise to source an attractive deal.

2. SPAC Target

This term refers to an operating company that is either acquired by or merges with a SPAC and eventually becomes a public company. SPAC founders usually are looking for such companies, and hence they are a SPAC Target. In some cases, the existing owners of these companies or SPAC targets sell their equity. But generally, the infusion of capital is used to accelerate growth. Historically, most SPACs sought out companies with positive EBITDA, but recently pre-revenue companies with alluring investment concepts have been acquired too.

3. SPACs relatively low-risk structure

SPACs provide investors the ability to recoup their initial investment at their discretion with the opportunity to participate in the upside of a privately negotiated deal. IPO investors receive a “unit” that includes one stock share and either a whole or fractional warrant to purchase additional shares. Therefore, investors can back out at will or choose to buy in more.

4. PIPE

Private Investments in Public Equity (PIPE) is when an institutional investor buys stock directly from a public company below market price. PIPE has become a common feature in closing SPAC acquisitions to boost capital investment or to increase the overall transaction.

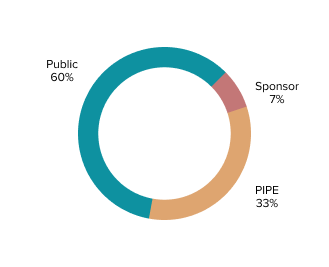

The cap table of a SPAC post IPO, but before an acquisition could look something like this:

SPAC popularity in the recent years

Recently, the change of regulations favoring SPACs and stock exchanges welcoming them has given further momentum to SPACs. Here are some of the key factors behind the recent popularity of SPACs:

1. Stock Exchanges

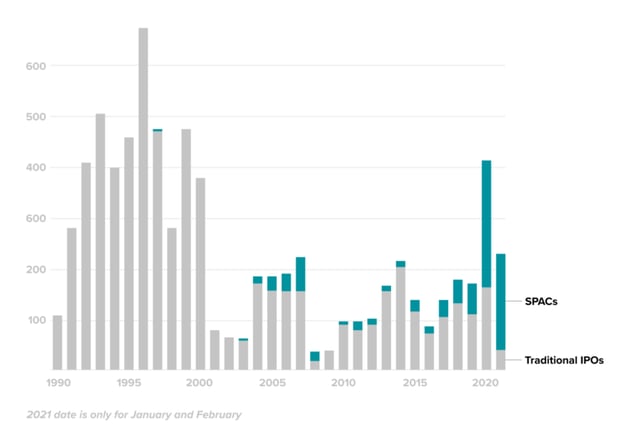

In the last 30 years, the number of companies going public has decreased dramatically, and the trend seems to be changing due to SPACs. This is so because the amount of money flowing into the public markets has been increasing. Since SPACs are an easier way for companies to enter the public markets, most stock exchanges welcome SPACs to bring more money, which ultimately benefits them.

2. The private equity market

The current investment in the private equity market is about $2T and increasing. However, the number of exits is decreasing. Private equity-backed portfolios are always looking for opportunities to exit and generate a return, so they support the SPAC model.

3. SEC regulations

With the SEC becoming more involved in regulating SPACs, the significance of SPACs is increasing. The SEC helps set a fixed price for each IPO and regulates voting and redemption rights to the benefit of all parties involved. By having the SEC involved, SPACs have gained a boost in credibility.

Benefits of SPACs against traditional IPOs

When market volatility increased due to the Covid-19 pandemic, SPACs entered the spotlight. SPACs are less prone to market movements and offer several advantages to companies like:

1. Ease of IPO

SPACs is an easier route to an IPO, even for small or struggling companies, which face challenges in traditional IPOs.

2. Time-Efficient

While a traditional IPO may take up to years to complete successfully, SPACs generally take in a shorter duration of a few months.

3. Cost-Efficient

SPACs cost much lower than traditional IPOs that are expensive to execute. More often than not, SPACs also pay the required costs.

4. Valuations

SPACs offer an opportunity for a higher valuation, offering the company the ability to decide.

5. Liquidity

SPACs offer security in liquidity through the cash raised in the IPO.

6. Certainty

Since SPAC deals are identified ahead of time, and the valuation is agreed upon by both parties, it is certain that the transaction will occur and that it’ll be at a value you agree with.

Risks in SPACs investing

While these points indicate that SPACs should be widely adopted, there are a few risks of SPACs. The due diligence of the SPAC process may not be as rigorous as a traditional IPO, which leaves room for errors. Moreover, the SPAC sponsors have to find a company worth acquiring within two years of the IPO, otherwise, the SPAC gets liquidated, and the investors get their money back. The 2-year deadline can result in a poor choice of acquisition.

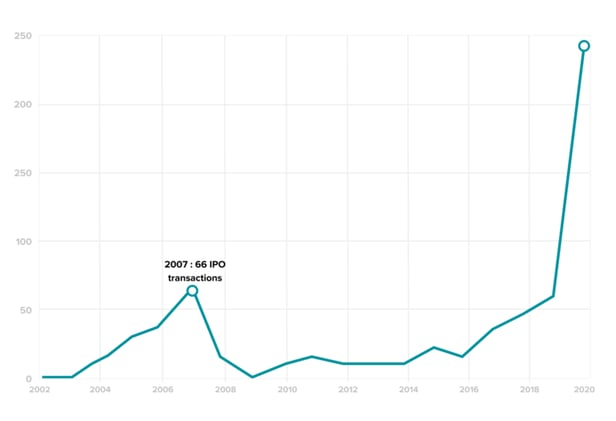

However, NYSE allowing SPAC listings from 2017 and the Covid-19 pandemic have given SPACs a boost in popularity. In the year 2020, SPACs contributed significantly to the growth in the US IPOs. SPACs raised $80B+ in gross proceeds from 230+ IPOs compared with $13.6B in 2019 from 59 IPOs. Additionally, three months into 2021, $97B has already been raised by almost 300 SPAC IPOs. 2021 is likely to be a big year for SPACs and the IPO market.

Events In An SPAC Lifecycle

Initiation

The cycle of a SPAC traditionally begins with the purpose of acquiring a company. The first stage of this is the SPAC’s IPO. Until then, the SPAC managers, investors, underwriters, and sponsors, join hands to create the SPAC. The unit of investment is usually priced at $10 and consists of one share of common stock and a warrant for half a share at a price of $5.75. Fifty-two days later, the units can be separated to be traded as shares, warrants, and rights. The proceeds of the IPO are used to buy the target company. The SPAC needs to go public so that the target company benefits from the public status in an eventual merger.

Rumour

Rumour mills play a crucial role in a SPAC’s popularity. A story by Bloomberg spoke about a SPAC named CIIG Merger Corp (CIIC) merging with Arrival. CIIC jumped 10% on the news. The merger was announced the next day, sending the stock soaring by as much as 300% within a week.

Target Search

From the date of the IPO, the SPAC has two years to complete an acquisition. The SPAC identifies and conducts due diligence on potential targets. As shareholders can redeem shares, the sponsors need to closely monitor cash to ensure sufficient funding to acquire the target and manage post-close operations. A definitive agreement between the SPAC and the acquisition target marks the end of the selection process.

De-SPAC Process

This de-SPAC process may take 4-6 months to complete, and involves conducting due-diligence on the target acquisition, and obtaining approval from SPAC shareholders, in compliance with the SEC regulations. A target company would look for a de-SPAC transaction as a less expensive method to go public than the traditional IPO.

Voting

The shareholders use a proxy statement Schedule 14A to vote on the proposed merger. If the SPAC registers securities as part of the merger transaction, it will file a joint registration and proxy statement on Form S-4. The form includes the following additional information:

- SPAC’s financial statement

- Financials of the target company

- Management’s discussion and analysis of the SPAC and the Target Company, merger background, and risk factors, among others.

The SPAC will seek shareholder proxies, which are generally mailed 20 days ahead of the vote, and then conduct voting for seeking approval on the merger. Post consumption, a current report on Form 8-K is required to be filed within four business days.

Warrant Conversion

On the closure of the deal, all units, shares, warrants, rights automatically convert to the corresponding units, shares, warrants, rights of the newly formed company. The new company’s stock doesn’t always soar on the back of a deal. If it does go above a certain threshold (defined in the prospectus), the company may call the warrants for redemption. Warrant holders get a deadline before which they can either exercise their warrants or sell them. In neither scenario, their warrants become worthless.

Redemption in case of No De-SPACing

If there is no de-SPAC transaction that takes place within the specified period, which usually is two years, the holders of SPAC shares will redeem them for $10 each, and the SPAC is dissolved. In such a scenario, the founder loses his/her seed capital, SPAC warrants turn worthless, and underwriters will not receive their deferred fees.

Things to consider when investing in a SPAC

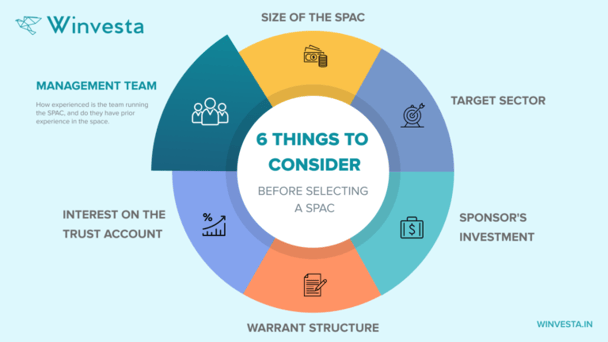

Investing in SPACS is more or less similar to investing in the stock market. Investors will have to do primary research and consider factors that can influence the SPAC in the short and long term. The following are certain areas that investors should look into before investing in a SPAC:

1. Management Team (SPAC Sponsors/Founders)

When investing in a SPAC, investors need to look at the founding or management team behind it. Investors must do their due diligence on the SPAC members who will be responsible for negotiating contracts with privately held companies.

Generally, founding members with a strong reputation bring a lot of attention to the SPACs. Such founding members have a proven track record and a demonstrated ability to find suitable target businesses. SPACs with stellar founding members typically command a premium.

2. Acquisition Candidate or Sector

A SPAC often declares the acquisition candidate, the target sector, or an investment theme, which helps investors select the right SPAC. An investor looking to invest in the health sector could thus focus on the SPACs targeting that market.

3. Size of the SPAC

The size of the SPAC is indicative of the size of the target company, and the confidence in SPAC management. Successful managers like Chamath typically look at SPAC sizes greater than $500m.

4. Sponsor’s investment

SPAC sponsors typically receive 20% of the common equity in the SPAC for a much lower investment. The sponsor’s investment can be 3% – 5% of the IPO proceeds, which is often in the range of $5-15 million. The larger the sponsor’s investment, the more confidence investors have in the management.

5. Warrant structure

The terms of warrants can vary significantly between SPACS. Investors must take a closer look at the expiry date of warrants, exercise price, the circumstances under which the SPAC may be able to redeem the warrants, and expected dilution from the exercise of all warrants.

6. Interest on the trust account

Typically, a trust account holds the IPO proceeds and invests them in relatively safe interest-bearing instruments. SPACs may pay a small interest to investors from this earning, and use part of it for its expenses and taxes. It’s one of the smallest factors for consideration but can make a difference in case of redemption from an unsuccessful SPAC.

Notable SPAC Mergers and Acquisitions

Since 2020, many big names have sprung up, benefitting from SPACs, while some popular companies went public. The SPAC popularity helped companies raise billions of dollars without going through the tedious IPO process.

Notably, the most prominent person riding the SPAC wave is none other than Venture Capitalist and Social Capital CEO Chamath Palihapitiya. Also known as SPAC king, Palihapitiya was early to the SPAC wave, sponsoring a blank-check company that merged with Richard Branson’s space startup Virgin Galactic in late 2019. Since then, the former Facebook executive has sponsored SPAC IPOs for online real estate firm Opendoor and health insurance company Clover Health. Palihapitiya has three more blank-check companies on the market, with one in agreement to take Fintech startup SoFi public. So far, Palipithiya has gained an estimated $1.2B just from SPACs.

Another popular SPAC merger is Nikola, an electric vehicle maker. The company hadn’t produced a single vehicle but was one of the biggest IPOs of 2020, as soaring shares pushed its founder Trevor Milton’s net worth to more than $8B. However, this SPAC was didn’t fly as high as investors expected it to. Acquisition and allegations against Trevor for lying about the technology used forced him to resign as CEO. The series of events highlighted the lack of due diligence in the SPAC process compared to the standard IPO and brought in some criticism and skepticism surrounding SPACs.

However, it wasn’t enough to stop the SPACs from surging in popularity. Here are some other notable companies that used a SPAC to go public:

- QuantumScape (QS): The solid-state battery developer for electric vehicle use has agreed to merge with the SPAC company Kensington Capital Acquisition. Its shares jumped about 50% on the first day of trading and made a gain of around 388% in Mar 2021.

- DraftKings (DKNG): The digital sports entertainment and gaming company DraftKings merged with SPAC Diamond Eagle Acquisition Corp and SBTech (DEACU) in April 2021.

- Paya Holdings Inc. (PAYA): FinTech Acquisition Corp. III acquired Paya, turning it to Paya Holdings Inc., an integrated payments provider. The new stock started trading in public markets in Oct 2020.

- Fisker (FSR): Another EV maker Fisker jumped on the SPAC wave as a reverse merger with Spartan Energy Acquisition Corp. Fisker is publicly listed and trades on the NYSE.

SPACs have become so popular and investment-worthy for entrepreneurs that they even invited celebrity interest. Recently, stars like Shaquille O’Neal, Alex Rodriguez, and David Geffen are amongst a few to join the SPAC wave.

How to Invest in SPACs from India?

Investing in SPACs is similar to investing in publicly traded companies. If you’re in India, you can now sign up for Winvesta, and use the platform to invest in SPACs along with 3500+ other US stocks and ETFs. Winvesta has 50+ SPACs available on the platform and we are constantly adding new ones. You can see the available SPACs, and use the sector filter to select SPAC.

To start investing, download the Winvesta app here.

Disclaimer: All content provided by Winvesta India Technologies Ltd. is for informational and educational purposes only and is not meant to represent trade or investment recommendations. Remember capital is at risk. Terms & Conditions apply.