Contents

Understanding TCS on Foreign Remittances

2 minutes read

24 November 2024

What is Tax Collected at Source or TCS on overseas transactions?

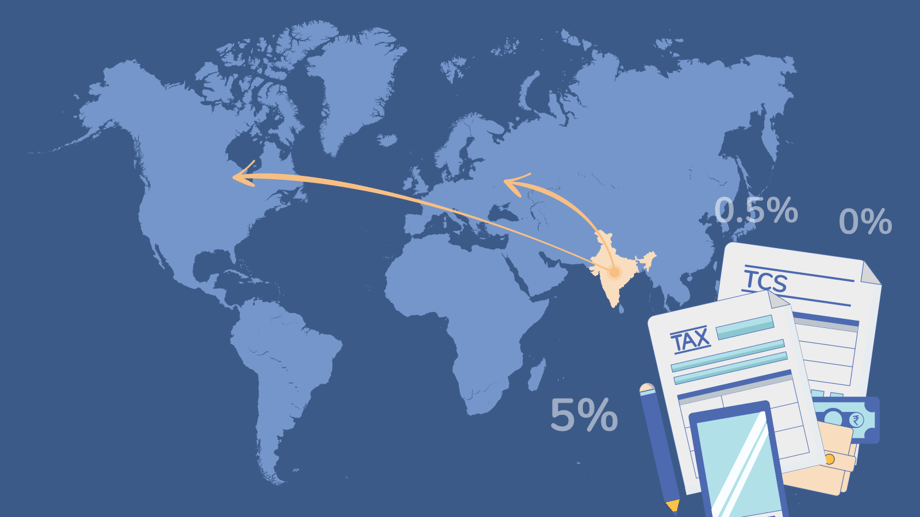

The Union Budget 2020 introduced a tax collected at source (TCS) on forex transactions. A 5% TCS will be applicable on all remittances above INR 7 lakh under RBI’s Liberalized Remittance Scheme (LRS). The same rate is also applicable to payments for foreign travel packages without any exemption threshold. In case you do not provide your Aadhar or PAN Card to the Authorized Dealer, a 10% TCS will be applicable.

It is important to note that the tax is applicable ONLY on the payer, and not on the recipient. The payer will get a TCS certificate and can claim a refund while filing the annual IT returns.

Who will collect the tax?

Generally, the bank – Authorized Dealer (AD) of the given foreign exchange – will collect the tax and transfer it to the Government. In the case of overseas travel, the travel agency or operator shall collect the TCS.

What is LRS?

LRS or Liberalized Remittance Scheme, allows you to remit up to $250,000 (around INR 1.83 Cr at an exchange rate of 73.50) per person per financial year. The scheme includes expenses such as travel and education, as well as capital account transactions like investing in the foreign stock markets.

What are the amendments to the TCS Rule?

Based on the communication from banks like ICICI and HDFC, here are the changes in the TCS rule:

- The Tax Collected at Source (TCS) will come into effect on October 1, 2020, instead of the initial date of April 1, 2020

- TCS will apply only to the amount over INR 7 lakhs in a fiscal year and NOT on the total amount.

- For instance, if you remit up to INR 10 lakhs in a financial year, TCS will apply to the excessive INR 3 lakh at a rate of 5%, and thus will incur a tax of INR 15,000.

- If the remittance amount is for an educational purpose which is originating from a loan from a financial institution in India, a reduced 0.5% TCS is applicable on amounts exceeding INR 7 lakhs.

- For transfers to Foreign Tour Operators via a bank, 5% TCS is applicable on the whole amount, without any threshold.

- TCS will not be applicable if you book a foreign tour yourself instead of going through a travel agency.

- TCS will not be applicable if the remitter is subject to TDS under the IT-Act 1961

- For example, if you transfer money over INR 50,000 to a non-relative NRI as a gift, you incur TDS on the remittance and not TCS.

- In the case of transfer between parents and children or vice versa, TCS will be applicable instead of TDS.

- As per the IT-Act 1961, if you are a non-resident, the TCS rates are subject to increase by applicable surcharge and Health & Education Cess.

Who all are Impacted by the new rules?

The rule change will impact Indian investors investing in overseas stocks, bonds, and property. All Indian students studying abroad and tourists planning a foreign trip will also be affected. Though these new rules increase the upfront costs of overseas investing and expenses, the tax can be claimed back as a refund while filing the income tax return.

Conclusion

Indian investors looking to invest in US stocks or globally should not be discouraged from the new TCS rules. While it does increase upfront costs in some cases, it can eventually be claimed back with tax returns. Investors remitting less than Rs 7 lakh per year (about $9500 at an exchange rate of 73.5) should see no impact of these rules.

Contributed by Swastik Nigam

Our Founder and CEO has been steeped in the world of finance since 2011 working with organisations such as Procter & Gamble, Larson and Toubro and Deustche Bank. Swastik’s love for finance literacy and helping businesses and individuals to make better financial decisions and grow their personal wealth has resulted in many such blog articles, talks, content pieces and social media content. Follow him to learn about the process of building a successful global business and tips on growing your personal wealth.