Contents

UK as an Education and Investment Destination for Indians

2 minutes read

14 May 2024

In a major boost for Indian students, the UK government announced a new two-year post-study work visa from 2020-2021, expanding opportunities for talented international students to build successful careers in the UK. This will increase the attractiveness of the UK as an educational destination for prospective Indian students.

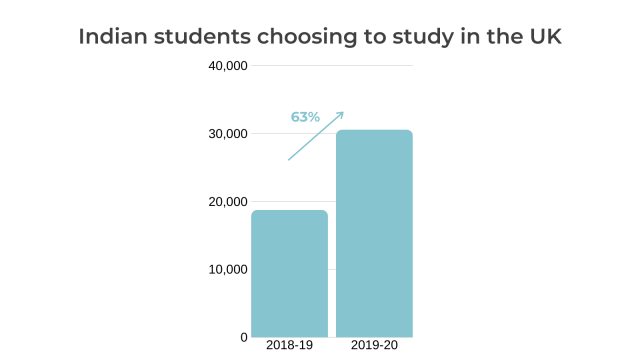

In the year ending Sep-2019 30,500 Indian students headed to the UK. This is the second largest international student body in the UK behind China. At a 63% y-o-y increase it shows the increasing preference for the UK as a destination for Indian students. This increase is almost four times the total increase in foreign students in the UK for the same time period.

How does one plan for this financially?

The UK government clearly wants to attract and retain international talent. If you or a family member is looking to study in the UK in future, it may be prudent to start financial planning for the same. The expenses for studying in the UK can easily run over a hundred thousand pounds. However, just saving for foreign education in INR is sometimes not enough. In the last 3 years, GBP has appreciated by 14% against the INR, and by 36% in the last 10 years. This is despite the British economy struggling with Brexit uncertainty.

GBPINR from 2017-2020

To protect your savings and investments from INR depreciation, it could be helpful to save or invest in GBP. Winvesta allows Indian residents to open a multi-currency account in minutes which could be used to hold money in GBP, USD and EUR, reducing the INR risk on your future international expenses. One may remit money annually to build up assets systematically. Union budget 2020 imposed a 5% tax collection (TCS) on foreign remittances over Rs. 7 lakh. By remitting under that amount annually, individuals can also save the upfront cash that would otherwise need to be shelled out.

Individuals can also open investment accounts in the UK, or buy real-estate, using the international bank account for maintenance and collection of income. This way they can aim to grow the savings rather than just collecting money for the future education goal. On that subject, we will now address attractiveness of UK as an investment destination.

Attractiveness of the UK as an investment destination

The UK investment case has been driven by uncertainty around Brexit since last few years. However, since Prime Minister Boris Johnson led the Conservative Party to a landslide victory in Britain’s election, the Brexit debate is largely over. Also, the UK chose not to head for a hard-left government by voting for the Conservative party against Jeremy Corbyn’s Labour Party.

The resolution of this uncertainty is being reflected in the economic indicators. ‘The figures from the Office for National Statistics confirm that the decisive general election has released the handbrake of political uncertainty on consumer spending’, Samuel Tombs, UK economist at Pantheon Macroeconomics, said. Unemployment is at record lows. And the manufacturing is well up and now into expansionary territory.

This has led to increased attention on UK assets from professional investors. For e.g. the Financial Times has reported that the US alternative investment group – Blackstone is bullish on the UK infrastructure assets viewing them as undervalued. The FTSE 100 index is trading at a P/E Ratio of 16.6 (vs over 22 for S&P 500) with an attractive trailing dividend yield of 4.31%. The FTSE 100 index can also be accessed via the EWU ETF on the Winvesta platform (Base Tier).

Advanced planning for education in the UK can thus offer attractive portfolio diversification, along with protecting against the INR depreciation.

Free e-book: How to Build a Globally Diversified Portfolio from India

Get a step by step guide including the considerations, current channels, and costs for building an efficient global portfolio.

Get your free e-book

Contributed by Prateek Jain

He is the Co-founder & President of Winvesta. Before Winvesta, Prateek worked at Deutsche Bank for 11 years