Contents

Trump's tariff bombshell sends shockwaves through global markets

3 minutes read

03 April 2025

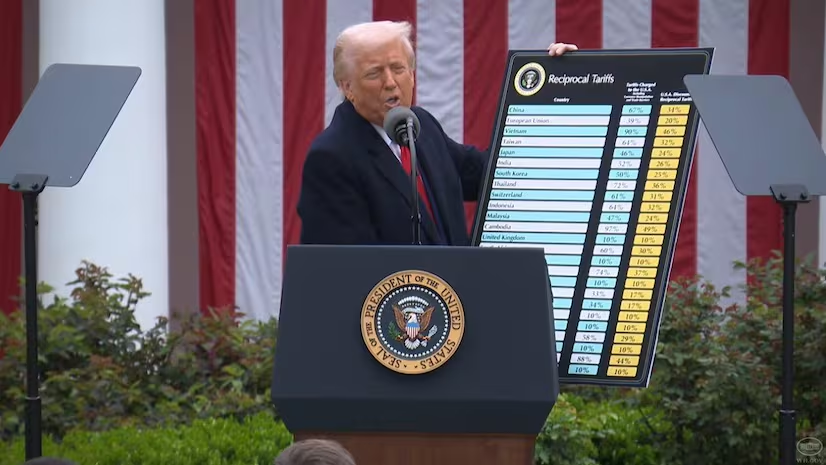

In a stunning and unprecedented move, President Donald Trump announced sweeping tariffs on all U.S. trading partners on April 2, 2025. The announcement, which includes a baseline tariff of 10% on all imports and significantly higher rates for specific countries, has sent shockwaves through global financial markets. The move is being hailed by some as a bold step toward "economic independence" but criticized by others as a potential trigger for a global trade war that could destabilize the U.S. economy.

The announcement has already had an immediate and dramatic impact, with U.S. stock futures plunging in after-hours trading and major corporations bracing for disruptions to their supply chains. Economists and market analysts are warning of inflationary pressures, slower economic growth, and heightened volatility in the days ahead.

"This is our declaration of independence," Trump declared during a Rose Garden press conference at the White House. "For too long, the United States has been taken advantage of in trade deals. Those days are over."

But while the administration celebrates the move as a win for American workers and businesses, Wall Street and global markets are telling a different story.

Trump's tariff plan is sweeping in scope, applying to over 180 countries and marking some of the highest U.S. tariff rates in over a century. The baseline tariff imposed was 10% on all imports.

Higher tariffs on specific countries:-

- China: 34%

- European Union: 20%

- Japan: 24%

- South Korea: 25%

- India: 26%

The administration argues that these measures will reduce the U.S. trade deficit and incentivize domestic manufacturing. However, critics warn that the sudden imposition of such high tariffs could severely disrupt global supply chains.

Market reaction

The immediate market response was severe. Futures for major U.S. indices plunged:

-

S&P 500: Dropped by 4.6%, marking its worst quarter since December 2022.

-

Nasdaq Composite: Fell sharply by 10%, reflecting its largest quarterly decline since September 2022.

-

Energy sector: Gained 9%, benefiting from its defensive nature as investors sought safer options.

-

Healthcare sector: Increased by 5%, further highlighting the shift toward stability during market volatility.

Tech giants and multinational corporations bore the brunt of the initial shock:

- Apple: Down nearly 7% due to fears of supply chain disruptions.

- Amazon: Dropped 6%.

- Walmart: Decreased by 5%.

- Nike: Plummeted by 7%.

Dan Ives, an analyst with Wedbush Securities, described the tariffs as "worse than the worst-case scenario that the market was dreading."

Economists warn that these tariffs could have far-reaching consequences for both the U.S. and global economies.

"Trump's new tariff measures are undoubtedly unwise, as fair trade is not realized through so-called reciprocal taxes," said JoAnne Bianco, an economist at Goldman Sachs. "These tariffs could upend global supply chains, stoke inflation, and drag on economic growth.".

The impact of Trump's decision extends beyond U.S. borders. Asian markets experienced significant declines overnight. Japan's Nikkei 225 Index dropped over 3.4%. While Shanghai Composite Index fell by nearly 2%.

"With the announcement of higher-than-expected tariffs, global investor sentiment is likely to take a hit leading to heightened volatility," said Krathi Bathini, Equity Strategist at WealthMills Securities.

Predictions for U.S. markets

Looking ahead, analysts foresee heightened volatility in U.S. equities as investors grapple with the fallout from these tariffs:

- Inflationary pressures: Higher import costs are expected to fuel inflation, potentially complicating the Federal Reserve's monetary policy decisions.

- Sector-specific declines: Trade-sensitive sectors like technology and retail may continue to face downward pressure due to rising input costs and shrinking consumer demand.

- Safe-haven assets surge: Gold and Treasury bonds will likely remain attractive as investors seek stability amid market uncertainty.

Sonam Srivastava, founder of Wright Research PMS, noted that "equities may remain under pressure in the near term," particularly in sectors reliant on global trade.

While the immediate outlook appears grim, some experts suggest that these tariffs could serve as a negotiation tactic rather than a permanent policy shift. Stuart Thomas of Precidian Investments remarked that "in the long run, I wouldn’t bet against the U.S. dollar or the country itself," citing potential benefits from energy policies and deregulation efforts.

While the immediate outlook appears grim, some experts suggest that these tariffs could serve as a negotiation tactic rather than a permanent policy shift. Stuart Thomas of Precidian Investments remarked that "in the long run, I wouldn’t bet against the U.S. dollar or the country itself," citing potential benefits from energy policies and deregulation efforts.

However, if retaliatory measures escalate or tariffs persist without resolution, the risk of a prolonged economic downturn increases significantly.

As markets digest this news, all eyes are on potential retaliatory measures from affected countries. Economists warn that this could escalate into a full-blown trade war with severe consequences for global economic stability.

Peter Tchir, head of macro strategy at Academy Securities, summed up the sentiment: "I believe this is a catastrophe."

The coming days will be crucial as investors assess the full impact of these tariffs on global trade and economic growth. With uncertainty looming large, market volatility is expected to remain high in the short term.

Ready to own a piece of the world’s biggest brands?

- Invest in 4,000+ US stocks & ETFs

- Fractional investing

- Zero account opening fees

- Secure and seamless

Start investing in just 2 minutes!

Build your global portfolio.

.png)

Invest in companies you love, like Apple and Tesla.

Track, manage, and grow your investments.

Contributed by Denila Lobo

Denila is a content writer at Winvesta. She crafts clear, concise content on international payments, helping freelancers and businesses easily navigate global financial solutions.

-Apr-03-2025-09-58-48-0150-AM.png?width=2290&height=1730&name=image%20(4)-Apr-03-2025-09-58-48-0150-AM.png)