Contents

US stock market rebound: Optimism amid tariff tensions and sector resilience

2 minutes read

08 April 2025

After days of extreme volatility, the U.S. stock market is rebounding. Futures surged early Tuesday morning, infusing optimism into investors as the lingering tariff tensions and the threat of geopolitical perils continue to haunt them. But why the rebound, and what lies ahead? Let's take a closer look!

Market recovery: Signs of optimism

Wall Street futures are returning after three days of turmoil that left the market battered. Dow Jones futures increased over 400 points, S&P 500 futures increased 60 points, and Nasdaq futures jumped nearly 200 points in early trading Tuesday morning. That follows Monday's session when the Dow Jones experienced its largest intraday swing ever, while the S&P 500 briefly drifted into bear market ground. Asian markets also began higher today, with Japan's Nikkei 225 rising nearly 6% and Hong Kong's Hang Seng gaining over 2.3%.

Experts are moderately optimistic about this rebound. Dr. VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services, explains that a short-term upturn is possible but sustained recovery will be only possible through policy changes. President Trump's sweeping tariffs, which are scheduled to be imposed April 10, will drive the U.S. economy toward stagflation, with inflation increasing while growth decelerates, he cautions.

Fabien Yip, a market analyst at IG Group, cites technical problems for U.S. indexes like the Nasdaq 100, off 22% from its February peak. Yip expects short-term rallies, but breaking above key resistance levels will be the key to a sustained recovery.-1.png?width=1600&height=900&name=Us%20stocks%20(4)-1.png)

Tariff tensions: The lingering threat

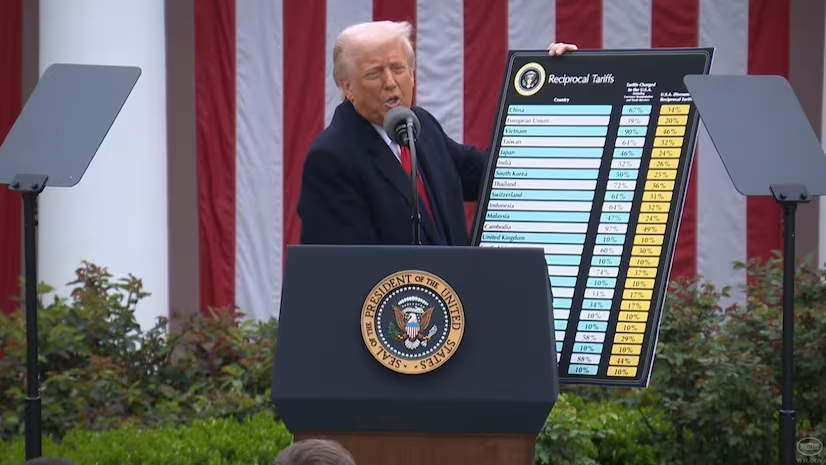

The rebound comes in the face of rising tariff worries. President Trump threatened additional tariffs on China if Beijing does not raise its recently implemented 34% tariff. The European Commission is also considering retaliatory tariffs on U.S. exports in response to Trump's actions on steel and aluminum.

Morningstar senior economist Preston Caldwell has reduced GDP growth forecasts for these tariffs, forecasting a paltry 1.2% growth in 2025 from a previous estimate of 1.9%. Caldwell cites that financial activity may be further skewed by inventory realignments and reduced imports in coming quarters.

Even while concerns about long-term volatility persist, State Street Global Advisors reassures investors that history teaches that markets usually rebound after corrections in excess of 10%. Their statistics show average gains of up to 14% within two years after such falls. Such experience instills hope that the current turmoil will eventually give way to long-term growth.

Sector resilience: Tech and healthcare shine

Among broader market troubles, there have been sectors that have remained strong. Technology stocks like Nvidia and Palantir saw buying interest as investors sought opportunities in growth areas. Healthcare stocks also increased on news of increased rates for insurers during Trump's regime.

While these sector performances provide opportunities for diversification, analysts are cautioned. Vijayakumar warns that a full-blown trade war will significantly affect world economic growth and trade. Investors should adopt strategic strategies—such as dollar-cost averaging—and stick to long-term objectives rather than act impulsively toward short-term moves.

The turnaround on the U.S. stock market gives investors some optimism in overcoming this challenging environment. However, with tariff tensions still unresolved and corporate earnings season in the near future, the road ahead is uncertain. Experts foresee caution and strategy to be needed in weathering this storm and preparing for better days ahead.

Disclaimer: The views and recommendations made above are those of individual analysts or broking companies, and not of Winvesta. We advise investors to check with certified experts before making any investment decisions.

Ready to own a piece of the world’s biggest brands?

- Invest in 4,000+ US stocks & ETFs

- Fractional investing

- Zero account opening fees

- Secure and seamless

Start investing in just 2 minutes!

Build your global portfolio.

.png)

Invest in companies you love, like Apple and Tesla.

Track, manage, and grow your investments.