Contents

Wall Street volatility: Stocks prepare for yet another sharp fall

2 minutes read

07 April 2025

The US stock market is struggling with record volatility following President Trump's draconian tariffs. Sunday evening futures trading indicated another tough day to come, after a week which erased trillions of value and drove major indices perilously close to bear market levels.

Market sell-off intensifies

Sunday night witnessed futures of the Dow Jones Industrial Average falling by more than 1,500 points, a 4% fall. The S&P 500 futures fell by 4.3%, and Nasdaq futures by 4.7%. This follows last week's record two-day sell-off, which wiped out more than $5 trillion of equity value in global markets.

The Nasdaq Composite has now moved into bear market territory, more than 20% below its February high point. The Dow and S&P 500 are close behind similar levels. The year-to-date numbers look even worse: the Dow is off by almost 10%, the S&P 500 by 14%, and the Nasdaq by a staggering 19%.

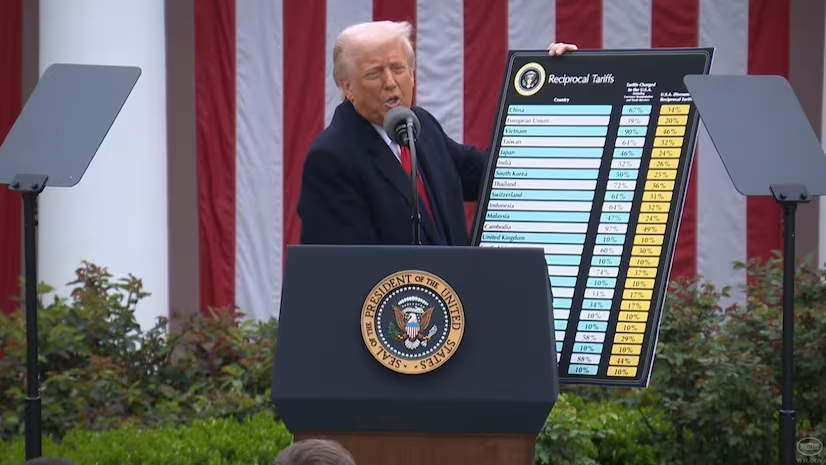

The main driver of this upheaval is President Trump's belligerent tariff strategy. Unveiled late Wednesday, these tariffs apply a base rate of 10% to imports, with some products subject to levies as steep as 50%. Economists predict that these actions will double inflation rates and severely decelerate GDP growth. Over the weekend, Commerce Secretary Howard Lutnick assured that the administration is committed to its course, further depressing investor sentiment.-1.png?width=1600&height=900&name=Us%20stocks%20(2)-1.png)

Investor fear and economic repercussions

The deepening trade war has generated widespread skepticism. China's retaliatory tariffs of 34% against US imports have further fueled fears, with worries of an extended economic downturn. Analysts believe that all these are likely to nudge the US into a recession, and JPMorgan puts the chances at 60%.

Investor nervousness is seen in the action of safe-haven assets. Gold prices have jumped as investors are taking refuge from volatility in equity markets. The Japanese yen and Swiss franc have also appreciated against the dollar, indicating increased risk aversion. US Treasury yields have declined sharply in the meantime; the two-year yield fell to its lowest since 2022.

The ripple effects are not limited to equities. Crude oil prices have fallen to a four-year low as investors worry about decreased demand in an economic slowdown. Bitcoin, which also briefly went over the $100,000 mark earlier this year, has also fallen—down more than 5% since the close on Friday.

In the coming weeks, investors are preparing themselves for further rough weather. Trading on Monday should prove to be crucial as markets absorb last week's losses and get ready to deal with more of the aftershocks from tariff policies. All-important economic markers such as inflation readings and Federal Reserve minutes will be followed intently for evidence of intervention or relief.

Wall Street faces an uphill battle to regain stability amidst mounting fears of recession and global economic slowdown. Unless there’s clarity on trade policies or intervention from policymakers, the road ahead looks increasingly uncertain.

Disclaimer: The views and recommendations made above are those of individual analysts or broking companies, and not of Winvesta. We advise investors to check with certified experts before making any investment decisions.

Ready to own a piece of the world’s biggest brands?

- Invest in 4,000+ US stocks & ETFs

- Fractional investing

- Zero account opening fees

- Secure and seamless

Start investing in just 2 minutes!

Build your global portfolio.

.png)

Invest in companies you love, like Apple and Tesla.

Track, manage, and grow your investments.