Contents

Routing Numbers: Must-Know for Indian Businesses and Intl. Clients

2 minutes read

24 July 2024

Routing numbers are really important for Indian businesses that work with clients from other countries. They help make sure that the money transfers between banks go smoothly. By understanding routing numbers, Indian businesses can:

1. Make international payments without any problems.

2. Identify the right bank for sending /receiving money accurately.

3. Make transactions faster and avoid delays.

4. Follow the rules and standards for international payments.

5. Manage their finances better and avoid mistakes.

Knowing routing numbers helps Indian businesses have a better experience when doing business with clients worldwide. So let’s learn what routing numbers are and how you can identify them.

Understanding Routing Numbers

Routing numbers are a unique code to identify banks or credit unions during financial transactions. They consist of nine digits and were created in 1910 to make transactions faster and better. Each bank has its own routing number, making transferring money clearer. Even if two banks have similar names, they have different routing numbers. Understanding routing numbers makes financial life easier:

1. Receive payments smoothly.

2. Transfer money efficiently.

3. Pay bills online.

4. Prevent errors.

5. Avoid delays.

Synonyms for Routing Numbers

In the realm of finance, specific terms refer to routing numbers. For example, you might come across terms such as ABA routing numbers, ABA transit numbers, or RTNs. All these terms depict the same underlying concept. These synonyms exist due to regional variations or diverse financial systems. Regardless of the terminology used, their purpose remains the same —to identify and facilitate the smooth functioning of financial institutions.

Locating Routing Numbers

Here’s how you can identify the routing number for your bank.

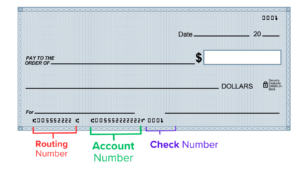

Examining Physical Checks

Finding your routing number on a check is easy if you have physical checks. Go to the bottom left corner of the check, and you’ll see a nine-digit code. This code is the routing number. The routing number is always with your bank account number and the check number. If you need help, you can check out some pictures or step-by-step instructions to quickly find the routing number on a check.

Leveraging Online Banking

You can avoid the hassle of searching for physical checks by retrieving your routing number online. You can find your routing number simply by logging into your online banking account and checking under “account details”. Say goodbye to the frustration of rummaging through cluttered drawers for a check!

Conclusion:

Knowing routing numbers is important for Indian business owners who work with international clients. Routing numbers ensures the money goes to the right bank. You can find the routing number on checks or online while using Internet banking.

Does your business have foreign clients?

If you are receiving international payments from your clients, you know there are various methods to receive international payments. However, these methods often come with high costs and lengthy processing times.

Global collections accounts offered by Winvesta are a great example of an alternate payment method growing in popularity. With Winvesta, businesses and individuals can open multi-currency accounts with a local US, UK, CAD receiving account and SEPA IBAN account number. So you can receive payments from 180 countries in 30+ currencies faster and cheaper. And withdraw to INR is as less as one day at rates starting at $3 + 0.99%

So if you are someone who is receiving international payments and is looking for a better alternative. Make international payments simpler by checking out Winvesta’s multi-currency accounts.

Open your Winvesta account today!

![Client vs customer: Why smart businesses know both [2025]](https://www.winvesta.in/hubfs/Copy%20of%20Blog%20images%20-%202025-01-28T164339.243.png)