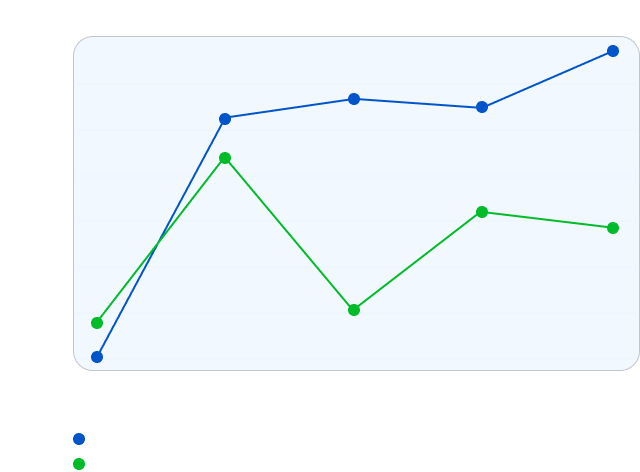

Missed the Dollar's Rise? Don't Let It Happen Again!

Consider the impact of currency trends on your investments.

If you don’t consider currency depreciation, you are missing out on the truth. Make choices your future self will thank you for!

| Year | Exchange Rate (USD to INR) |

|---|---|

| 2008 | $1 = ₹49.82 ↓ |

| 2020 | $1 = ₹74.13 ↓ |

| 2024 | $1 = ₹83.41 ↓ |

| 2030 | What will it be? |

Your child’s future costs dollars - why save in Rupees?

Don’t delay a global investment pot for your children's education.

Give your kids the best education opportunities. Invest in US stocks and ETFs to fund their world-class education and secure their financial future.

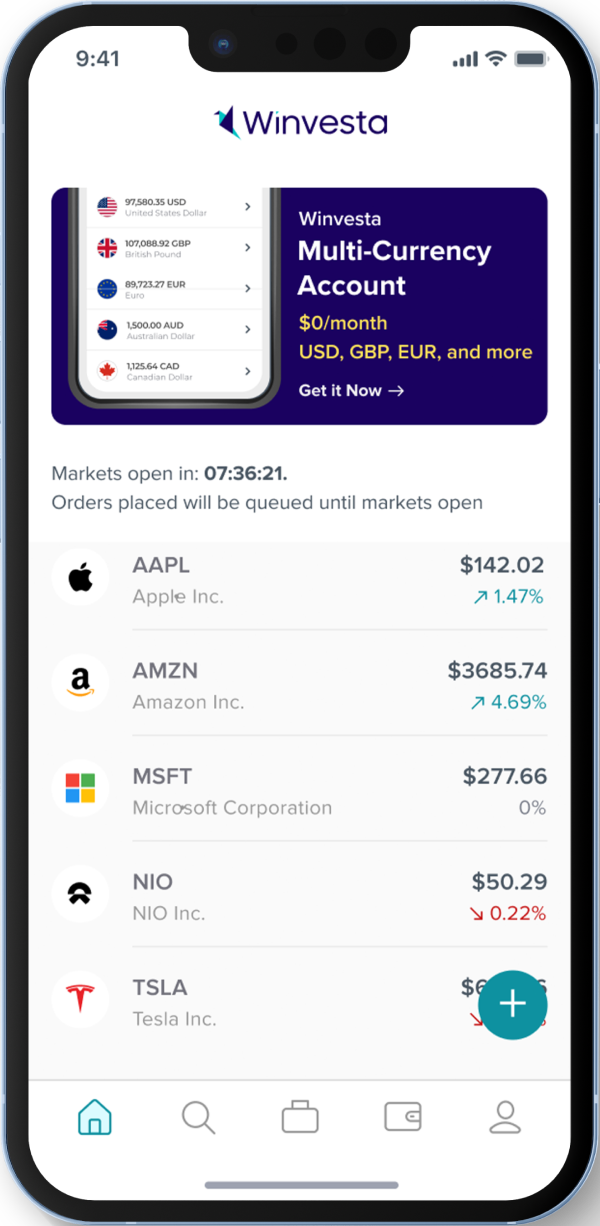

Why let your global profits slip through your fingers?

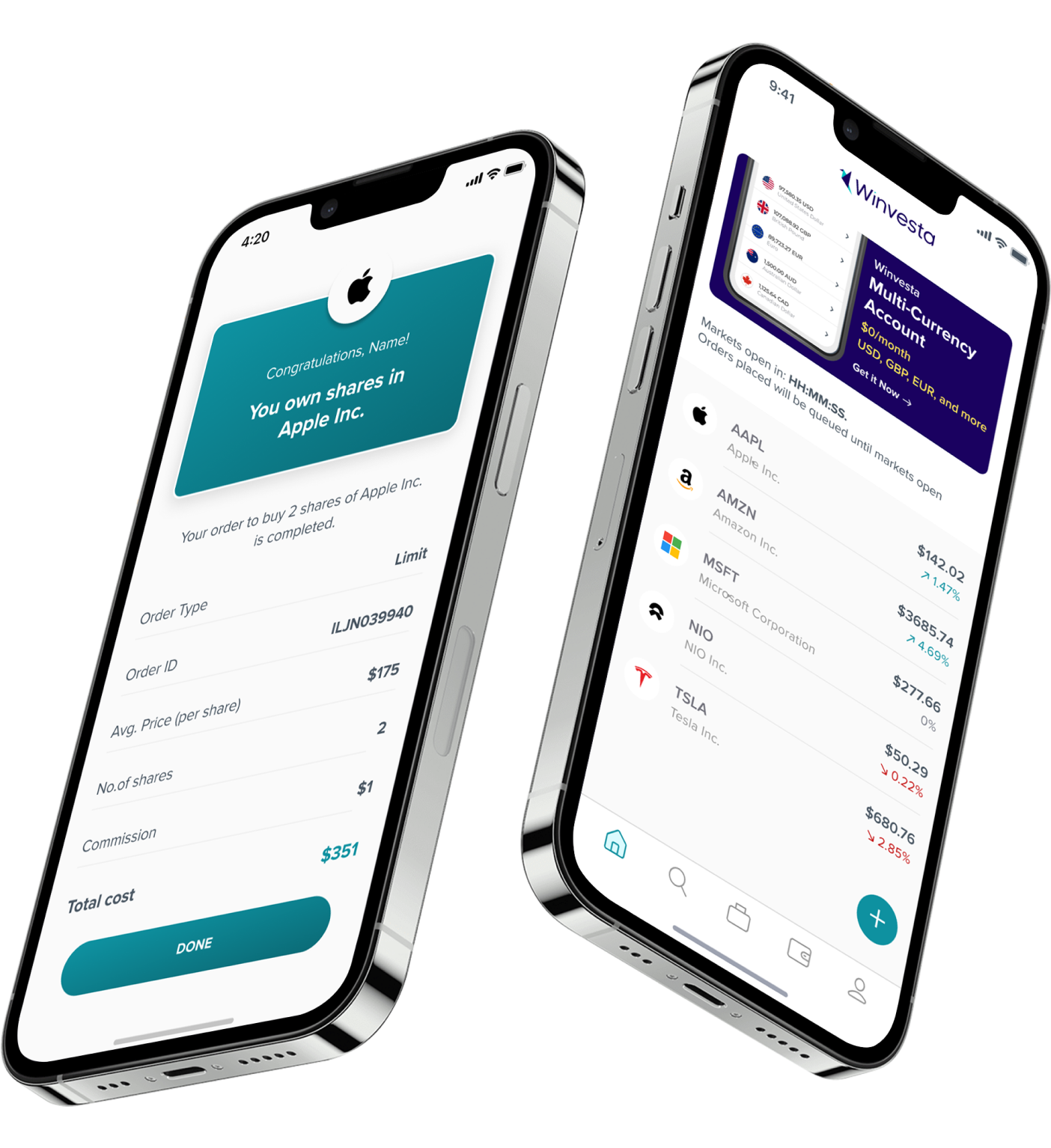

Sit in the comfort of your home and invest globally.

Save in dollars, not just rupees. With Winvesta, you gain access to international stocks previously beyond reach.

Don’t put all your eggs in one basket.

Diversify.

Diversify your portfolio and grab opportunities you’ve been missing out on. Don’t let these high-growth investments pass you by. Start investing globally today!

Your shortcut to smart investing

Why wait? Dive into the world of US stocks and ETFs today!

Fractional shares: small $$, big dreams

Own a piece of your favourite companies starting at just $1. No need to go all in!

Stock hunting? We’ve got you covered

Find hidden gems by theme, sector, or popularity. Discover new opportunities daily.

Fastest fingers in the east

Catch live market action or set it and forget it with overnight orders.

Leave the strategy to the experts

Build your portfolio without the heavy lifting.

Global opportunity in your pocket

Your full-service global investing platform

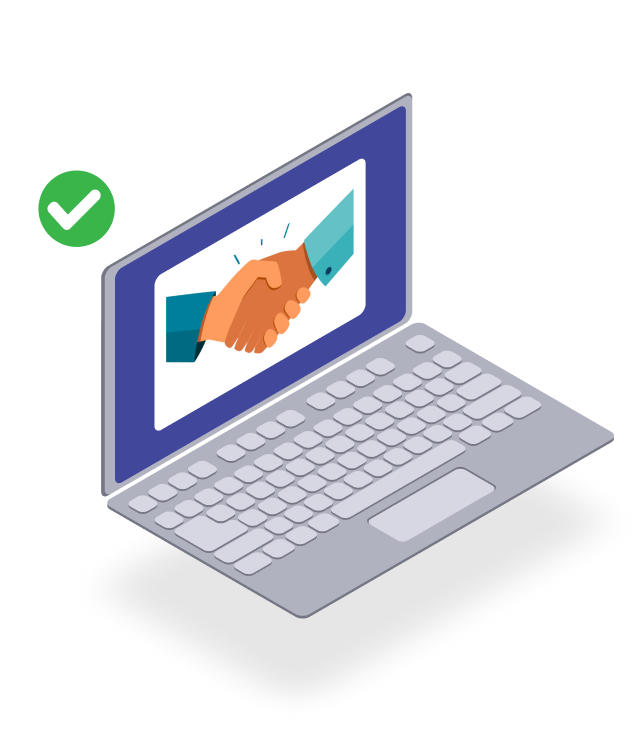

Who likes paperwork?

That’s why our digital onboarding lets you open an account in minutes. No paperwork required. KYC done fast, so you can start investing today!

Listen to experts

Check weekly updated ratings for top stocks and get expert opinions to guide your next investment move.

Channel your inner Buffett

Get smarter about global investing with our blog and newsletter. Plus, stay updated with Winvesta Crisps, your 3-minute daily market read.

See beyond the basics

Use our advanced charts and detailed financials to make informed decisions. Candle charts, bar charts, technical indicators, technical analysis, everything you need.

11,000 US Stocks and ETFs to Invest in

New stocks added every week, including freshly IPO’d stocks

The protection your money deserves

Your hard-earned cash deserves a secure, compliant, and trusted place

$500,000 SIPC Protection

Winvesta’s brokerage partner, Alpaca Securities LLC, is a member of the SIPC which protects the securities and cash in your account up to USD 500,000, of which USD 250,000 may be in cash.

Get Started In Minutes

You can now open a US brokerage account faster than you can open your domestic brokerage account. Get started now, and diversify your portfolio globally as early as today!

Sign up

15 mins

Fund your account

2 hours - 3 days

Start investing

As soon as today

Frequently asked questions about investing in US stocks from India

To begin investing with Winvesta, sign up online and provide personal details such as your name, phone number, and date of birth. You’ll also need to submit KYC documents like ID and address proof. Once your account is verified, you can fund it and start investing in US stocks and ETFs.

Winvesta is available to individual investors in India who have a valid Permanent Account Number (PAN) and a bank account. It’s ideal for residents looking to diversify their investments by accessing US markets.

Investing in US stocks can offer diversification, exposure to global companies, and the potential for higher returns. However, you should consider factors like market volatility and currency risk.

Winvesta offers a mobile app on Android and iOS. The app lets you manage your portfolio, buy fractional shares, and access over 4,500 US stocks and ETFs.

Yes, profits from US stock investments are taxable in India. Indian residents must report foreign income and pay taxes under the Income Tax Act.

You will have to pay taxes on US shares depending on how long you hold them.

a) Short-term capital gains (shares held for 24 months or less)

Taxed at your applicable income tax slab rate

b) Long-term capital gains (shares held for more than 24 months)

Taxed at a flat rate of 12.5% without indexation benefits, effective from July 23, 2024.